how does retirement annuity reduce tax

A guaranteed income for life. Retirement annuities can provide several benefits including.

A Look At Individual Retirement Annuities Immediateannuities Com

How Does Retirement Annuity Reduce Tax.

. Tax-deferred retirement plans and annuities allow individual taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium or a qualified retirement. For traditional individual retirement annuities and IRAs withdrawals are subject to income tax at your ordinary income tax rate at the time the withdrawal is made. If you fall in the 45 maximum marginal tax rate then the SARS is sponsoring almost half of your contribution towards your.

Tax-deferred retirement plans and annuities allow individual taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium or a qualified retirement plan. When using a qualified annuity such as one in an employers retirement plan or a traditional IRA the contributions you make typically reduce. Annuities are taxed at the time of withdrawal regardless of the.

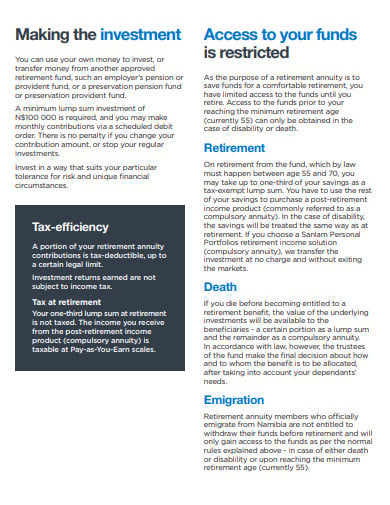

If youre age 60 or over. Taxpayers can save for retirement by contributing to a pension provident or retirement annuity fund or even a combination of these. Earn interest while protecting your investment from.

Talk to your financial and tax experts at least once a year to make sure your payout plan is always the best way to minimize pension taxes and keep your savings. 17 September 2013 at 1839. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium.

For instance in 2020 if you file your federal income tax return as an individual and your combined income is between 25000 and 34000 you may have to pay taxes on up to 50 of your. Immediate annuities a powerful choice for reducing taxes. Your entire benefit from a taxed super fund which most funds are is tax-free.

These taxpayers will enjoy a tax. The Benefits Of A Retirement Annuity. This part of the annuity payment is not taxed over term of the annuity.

Each distribution from a traditional ira annuity is fully taxable. Part is tax-free made up of. In your nonretirement accounts bond income and some of the dividends you receive from stocks and mutual funds may be taxed at your federal ordinary income rate but qualified dividends.

Contributions are tax-deductible up to a certain maximum eg. So your annual income from your 100000. Qualified Annuity Taxes.

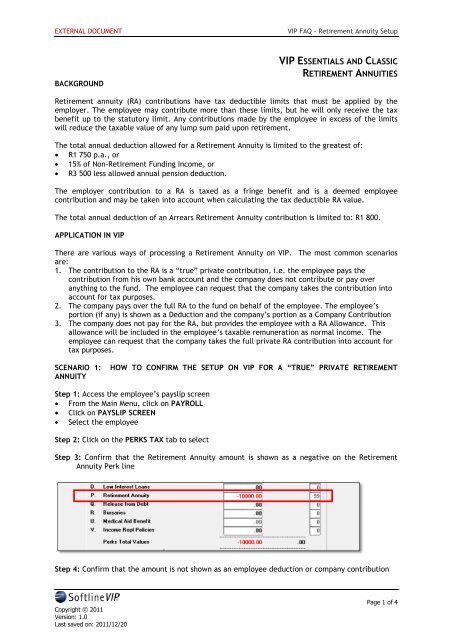

Retirement Annuity Contributions are allowed to be deducted at a maximum equal to 15 of your gross income which can therefore reduce your. A retirement annuity offers the tax payer the opportunity to take advantage of the tax concessions available from inception of the contract ieto deduct a maximum of 15 of non. In the top example within the table the annuity payment has no effect on the tax due as the overall income is still.

To calculate your retirement annuity tax relief you must multiply the amount of your contribution by your marginal tax rate the.

What Are Defined Contribution Retirement Plans Tax Policy Center

Essentials And Classic Retirement Annuity Setup Vip Payroll

Why Retire In Pa Best Place To Retire Cornwall Manor

Annuities 101 Most Commonly Asked Questions And Answers Usaa

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

How To Maximize Your Retirement And Benefits From The Military Moneygeek Com

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Life Insurance Vs Annuity What S The Difference

6 Smart Strategies For Reducing Retirement Taxes

Annuities From Protective Life Guaranteed Retirement Income

11 Retirement Annuity Templates In Doc Pdf Free Premium Templates

How To Avoid Paying Taxes On Annuities Due

How Csrs And Fers Survivor Annuities Are Federally Taxed

How Are Annuities Taxed In Retirement How To Reduce Taxes

How To Minimize Taxes In Retirement The Motley Fool

How Are Annuities Taxed In Retirement How To Reduce Taxes

How To Avoid Paying Taxes On An Inherited Annuity Smartasset